BY Gabriela Simone & Fiona Harrison-Roberts

“It is very frustrating to launch [a business] in Montreal,” says marketing expert Shawn Painter.

For the last two years, Painter has worked with a team of seven other people to develop and launch their startup. They created Flogrow.io, a software service company meant to help small businesses increase their cash flow, that plans to launch this summer.

Painter says government assistance programs weren’t any help.

“The only programs that grant money require a long process and best case scenario a payout six months later,” says Painter. “What startups need money later?”

The once popular arcade Amusement 2000 closed its doors downtown.

Small independent businesses are common in Montreal. Along the streets of downtown you can find numerous independent shops selling things anywhere from artisanal pastries to clothing. However, a lot of these stores now have ‘everything must go’ signs in their window displays.

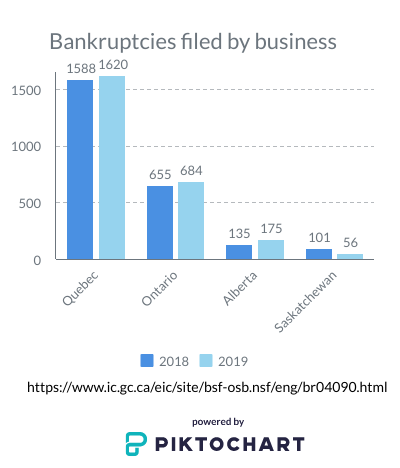

Quebec had the most business bankruptcies reported in 2019, with more than 1,600 bankruptcies. Ontario is a distant second with 684, while Alberta had 175.

Quebec has a high rate of businesses that file for bankruptcy. Infographic by Gabriela Simone.

Justin Fletcher, funding business consultant at Canada Startups, says his organization steps in to fill the financial void created by the delay in response from the government.

“We provide our members access to experts from across various industries, not just specializing in helping these individuals find funding, but providing them guidance with their business plans, private investors and the overall process,” says Fletcher.

In 2019, Canada Startups assisted approximately 3,000 people starting a business in Quebec, according to Fletcher.

The government does provide funding to entrepreneurs wanting to open a business, however, the application process is long and people often give up before they receive any funding.

“The 24/7 access to experts [at Canada Startups] is much better than waiting for up to two weeks to get an answer elsewhere,” says Fletcher.

The regulations surrounding starting a business can be difficult to navigate and this is why people become members of organizations such as Canada Startups and the Canadian Federation of Independent Business (CFIB). These organizations provide services faster than the government, if the government offers them at all.

“There was a lack of resources in explaining how [funding] works,” says Tracy Atieh, founder and CEO of her startup Kitschy. “It definitely would have made a difference to my company.”

Atieh had a mentor to help her develop Kitschy, a branding and marketing agency.

“This is the problem, most business owners have the misconception of government funding and ease of obtaining these funds,” says Fletcher. These misconceptions can land an owner in debt before they even opening their business.

Gopinath Jeyabalaratnam, principal policy analyst at the CFIB, believes that one reason that small businesses are disappearing from storefronts is that they’ve found success online due to lower costs.

Small business ventures can be costly, with lots of competition. Video by Fiona Harrison-Roberts.

The CFIB offers services similar to Canada Startups, for new business owners who may need help with financial aspects or other areas of their business.

Jeyabalaratnam says it is usually one of two reasons that a business closes. “Either because the business owner decided to close or the business is no longer profitable,” he says.

In cases where the business does not make enough profit, it is often the fault of governments, according to Jeyabalaratnam. Small and medium-sized enterprises (SME) are greatly affected by property taxes and infrastructure work that can hurt business.

“There’s 25 million dollars put aside by the government for SME’s that are impacted by infrastructure work,” says Jeyabalaratnam. “However, there is only one million dollars that has been given to help SME’s.”

He says requirements and eligibility for compensation are too strict. So businesses are not receiving the compensation for the loss of money their business sustained due to city work.

“How is it possible that there is a program to help avoid a company from going bankrupt, but there are still bankruptcies?” says Jeyabalaratnam. “The city could help provide more resources to these businesses to prevent them from reaching a point where they have to fall for bankruptcy.”

Canada recorded a 0.3 per cent increase of bankruptcies in Canada from 2018 to 2019. After their 12 month period, ending on March 31, 2019, 1,588 businesses declared bankruptcy in Quebec.

“The municipality has to see a loss of 15 per cent before coming to the help of a business,” says Jeyabalaratnam. “This number should be re-evaluated.”

Often these small businesses cannot accept losing up to 15 per cent of their sales because of the employees and expenses that must be paid.

Larger corporations tend to have more success in the city. Photo by Cristina Sanza.

Peter St. Onge, senior economist at the Montreal Economic Institute, says he believes larger commercial corporations will have more success than small businesses as long as governments don’t change how they treat small businesses.

“Taxes alone end up pushing these businesses out,” says St. Onge.

Commercial businesses, on average, pay four times the property taxes that a residential property does in Quebec. St. Onge explains that this is often why we see houses take the place of small businesses or restaurants.

“When [the government] is hitting businesses with a lump sum tax, what you’re essentially saying to them is ‘anyone who is small or unique, get out’,” he says.

St-Onge says governments have to lower costs and simplify their regulations if small businesses are to thrive in Montreal. With these independent businesses having to pay such a large amount in government fees, it forces them to increase the price of their products. Potential customers can then find similar products for less at chain stores.

Ste-Catherine street was the go-to street for shopping for decades, but the digital shift leaves it less crowded than is seen in this archive photo.

“It’s frustrating that there’s so much opportunity […] but it’s extremely expensive because of regulatory compliance,” says St. Onge.

He says these policies and taxes should be looked at through the small business owners perspective in order to understand the difficulties this poses on the owners.

“There is big government talk about supporting startups but in reality they offer nothing until you have cash flow,” says Painter.

For two years, Painter and his team have spent their time and money developing their startup. They hope it will all pay off. And they’ve done it all with no government help.