BY Nicole Alexakis & Matteo Miceli

“As a mother of two, including a disabled child, finding a suitable home for my family in this housing crisis feels like an impossible dream. The prices are out of reach for us right now,” says Hara Thalasinos, a single mother living in Montreal who lost her job due to the Pandemic.

Thalasinos and her family find themselves in a precarious situation as they bounce between temporary living arrangements during the week.

While residing with her parents on weekdays, the family packs up and moves to her sister’s home on weekends. Adding to her daily challenges, Thalasinos is managing two jobs which require her to leave home early in the morning and return late at night.

“It’s extremely difficult because I need a property that is handicap friendly, which is usually even harder to find and more expensive. I just feel bad for my kids at this point, not having a space of their own,” adds Thalasinos. “I’ve spoken to so many different financial advisors but they’ve all said the same thing. The market is too volatile right now and rates are the highest they’ve been in years so buying right now isn’t ideal.”

Emmanuel, Thalassinos’ son, trying to climb the front porch stairs at his aunt’s house. Photo by Nicole Alexakis.

According to the latest data from the City of Montreal, around 3,149 individuals were homeless in 2018, with 678 of them sleeping on the streets.

The COVID-19 pandemic has likely worsened this crisis, as the economic impact has caused many individuals to face job loss and financial insecurity.

According to Angelo Leone, a financial advisor at Bank of Montreal (BMO), the current high cost of living can be attributed to the interplay between inflation and interest rates.

Leone suggests that prospective homebuyers may need to reassess their priorities and consider alternative locations or properties in need of renovation.

“A few of my clients were able to get more value for their money by purchasing a home outside of Montreal,” Leone notes.

However, moving off-island isn’t an option for Thalasinos due to the demanding medical needs of her son. With doctor appointments every other day, the added strain of a long commute to the hospital is too much to manage.

“I’ve heard that properties are a lot less expensive outside of Montreal, but juggling two jobs in downtown Montreal and the kids is way too much for me to handle living so far away,” adds Thalasinos.

Leone emphasizes the importance of having a stable income when considering purchasing a home, and suggests that buyers aim for a 20 percent down payment in order to make their mortgage payments more manageable.

“Knowing the amount of the property you are willing to purchase and having a budget in place to save up properly is crucial,” Leone explains. “But it all starts with having a secure and stable income, and being realistic about what you can afford.”

Even those who have gone and purchased may not be able to keep up with payments. Video by Matteo Miceli.

“The current housing market can be overwhelming and challenging, especially for families with unique needs,” explains Voula Lianos, a real estate broker with Groupe Sutton Immobilia Inc. “The current housing market is simply not sustainable for many families. Before the pandemic mortgage rates were nearing 1.7 per cent and now if you’re trying to lock down a house at 5.5 per cent, it hurts.”

According to a recent report by the Canadian Mortgage and Housing Corporation (CMHC), the average price of a home in Montreal has increased by 22 per cent in the past year, making it increasingly difficult for families to secure a permanent residence.

According to Lianos, many of her clients are facing significant difficulties in finding and affording a suitable home.

“Numerous factors are contributing to the issue at hand,” Lianos explains. “With one of the primary factors being the substantial increase in interest rates. These high rates are forcing people to remain within the rental market.”

“On top of that, interest rates are also negatively impacting developers, who are forced to charge high rents to recuperate the costs associated with their investment financing which are leaving people without homes,”Lianos says.

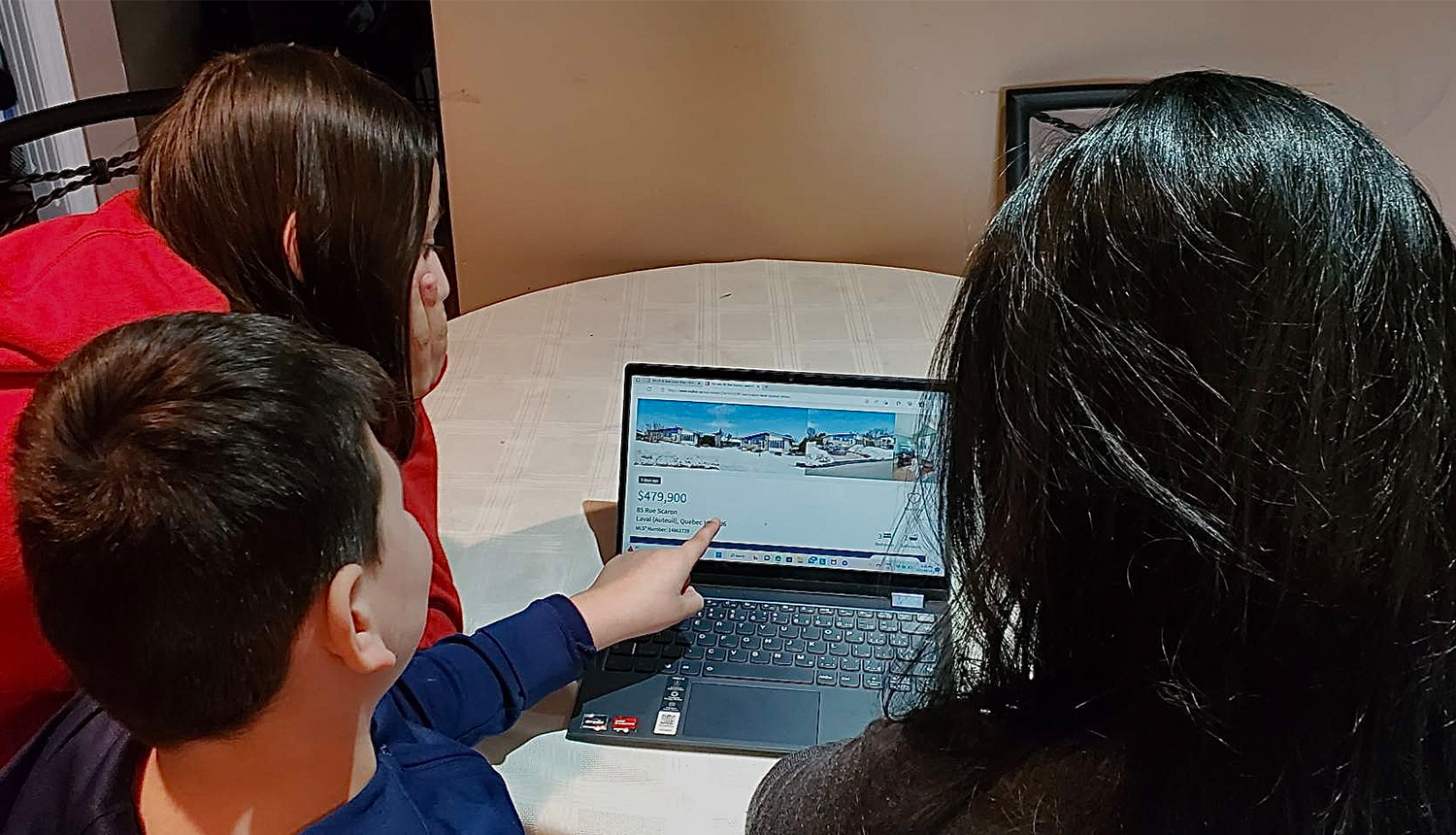

Thalassinbos and her children search for homes in Montreal. Photo by Nicole Alexakis.

According to George Goumas, an apartment owner, he has had to increase his rental prices significantly since the start of the pandemic. He now charges nearly three times more than he did before, with two-bedroom apartments renting for between $2100-2600 a month. Goumas acknowledges that this might be unaffordable for some renters, but he sees it as a reflection of the current economic climate.

“I know a lot of people who are struggling to find places to live in Montreal, it’s getting extremely pricey. My apartments aren’t even the tip of the iceberg, wait till you see the prices downtown Montreal,” Adds Goumas.

According to the CMHC, rent hikes were substantial, particularly for tenants who relocated. The average rent for new tenants in 2022 for a 2-bedroom apartment was $1,235, which was 28 per cent higher than the average rent of $963 for existing tenants.

Due to the combination of low vacancy rates and steadily rising rent prices, tenants have become more hesitant to relocate. The CMHC specifically states that, only 10 per cent of Montréal renters moved to a new address in 2022, which is significantly lower than the 16 per cent rate observed in 2019, just prior to the outbreak of the pandemic.

Thalassinos’ room with her children in her sister’s house, all three of them sharing one queen size bed. Photo by Nicole Alexakis.

Lianos suggests that instead of simply discussing plans, the government should take concrete steps to make housing more affordable for everyone. This could involve offering incentives, tax breaks, or other measures. One of the main challenges faced by developers is the high cost of building new homes, due to factors such as land, labor, and materials. As a result, there is a shortage of affordable housing options, which makes it difficult for many potential buyers to enter the market.

Zabaras calls for more assistance for single mothers who have lost their jobs due to the pandemic.

“We need some help,” she urges. “They need to cut us some slack and provide us with support.”